Kilimokwanza.org Team

Dodoma

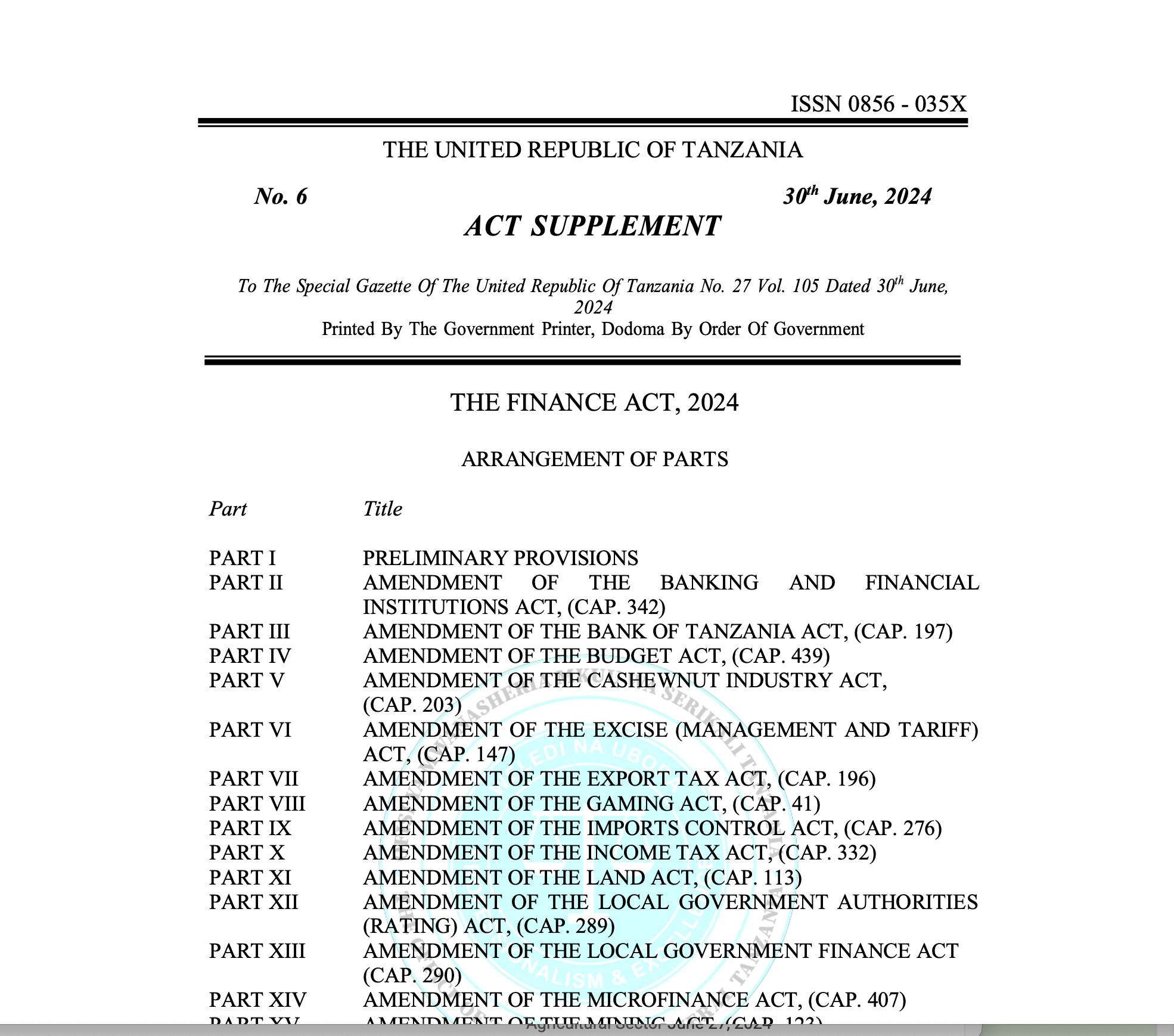

To bolster local industries, the Tanzanian government has introduced a new Industrial Development Levy as part of the Tanzania Finance Act 2024. This levy targets imported goods for home consumption in Mainland Tanzania, with certain exemptions for goods originating from East African Community (EAC) Partner States that meet the EAC Rules of Origin.

The introduction of the Industrial Development Levy is a strategic effort by the Tanzanian government to promote local manufacturing and reduce import dependency. This initiative aligns with the broader economic goals of fostering self-sufficiency and driving industrial growth within the country.

The levy will be applied to a wide range of imported goods, including wire rods, beer, wine, energy drinks, non-alcoholic beer, organic surface-active agents, cement clinkers, and Portland cement. The specific rates vary, with items like wire rods and cement clinkers facing a 10% levy, while beer and energy drinks are subjected to a 5% levy.

To support regional trade agreements and economic cooperation, the levy exempts goods that originate from the EAC Partner States, provided they meet the established Rules of Origin. This exemption ensures that intra-regional trade remains robust and encourages neighbouring countries to engage in mutually beneficial economic activities. While the Industrial Development Levy is poised to benefit local industries, it may also lead to higher consumer prices, at least in the short term.

Recognizing Digital Assets in Tanzania’s Tax Landscape

In a progressive move to adapt to the evolving digital economy, the Tanzanian government has updated its tax laws to include digital assets. The Tanzania Finance Act 2024 now recognizes digital assets as taxable entities, ensuring that income generated from these assets falls under the purview of the Income Tax Act.

With the rapid growth of the digital economy and the increasing popularity of cryptocurrencies, digital content, and other virtual assets, Tanzania is taking steps to modernize its tax framework. This update aligns with global trends, where countries are revising their tax codes to encompass digital assets, ensuring comprehensive revenue collection in the digital age.

The term “asset” in the Income Tax Act now explicitly includes “digital asset.” This change means that any value held in digital form, including cryptocurrencies, tokens, digital content, and other forms of electronic value, is subject to income tax. This move ensures that individuals and businesses engaging in digital transactions are taxed fairly and transparently.

While including digital assets in the tax framework is a positive step, it also presents challenges. Taxpayers and the Tanzania Revenue Authority will need to navigate the complexities of valuing and reporting digital assets. Experts suggest that ongoing education and clear regulations will be essential to ensure smooth implementation and compliance.

Centralizing Sugar Importation to Stabilize Tanzania’s Domestic Market

To stabilize the sugar market and ensure consistent supply, the Tanzanian government has granted the National Food Reserve Agency (NFRA) the exclusive mandate to import, store, and distribute sugar for domestic consumption. This significant policy shift, part of the Tanzania Finance Act 2024, aims to address the country’s sugar shortages and price fluctuations. Sugar is a vital commodity in Tanzania, affecting both the food industry and everyday consumers. However, the country has faced periodic shortages and price volatility, which have impacted the economy and livelihoods. By centralizing sugar importation through the NFRA, the government seeks to create a more stable and predictable sugar market.

The Finance Act 2024 stipulates that the NFRA will be responsible for importing sugar to cover any gaps in domestic production and maintaining buffer stock. This centralization means that the NFRA will manage all aspects of sugar importation, from procurement to distribution, ensuring that the market remains well-supplied and prices remain stable.

Tanzania Tightens Cargo Compliance with New Regulations for Consolidators

The Tanzanian government has introduced new regulations for cargo consolidators as part of the Tanzania Finance Act 2024 to improve transparency and compliance in the importation process. These regulations mandate that consolidators adhere to customs and other relevant laws during deconsolidation. This initiative aims to enhance the country’s cargo handling efficiency and legality.

Cargo consolidators play a crucial role in Tanzania’s importation process by combining smaller shipments into a single container, thereby reducing costs and streamlining logistics. However, this process has sometimes been marred by regulatory non-compliance and lack of transparency, leading to revenue losses and legal issues. The new regulations seek to address these challenges by ensuring that all parties involved in deconsolidation follow strict legal protocols.

The new regulations require cargo consolidators to fully comply with customs laws and other pertinent regulations during cargo deconsolidation. This means that all goods must be accurately declared, appropriate duties and taxes paid, and any required documentation properly submitted. Failure to comply can result in significant penalties, including fines and the potential seizure of goods.

Supporting Tanzania’s Cashew Industry through New Export Levy Allocation

The Tanzanian government has mandated that all export levies collected on cashews be remitted to the Cashewnut Board for the next five years to bolster the cashew industry. This directive, part of the Tanzania Finance Act 2024, aims to enhance the development and sustainability of the cashew sector, which significantly contributes to the country’s economy.

The cashew industry is one of Tanzania’s top agricultural sectors, contributing significantly to the livelihoods of thousands of farmers and generating substantial export revenue. Despite its importance, the sector has faced challenges, including fluctuating market prices and limited access to development funding. The new policy to direct all export levy funds to the Cashewnut Board seeks to address these issues by providing a stable financial base for industry support and development programs.

Starting July 1, 2024, the entire export levy collected on cashews will be allocated to the Cashewnut Board. This allocation will continue for five years, ensuring a dedicated revenue stream to support various initiatives to improve the cashew industry.

Ensuring Plant Health with New Fees and Charges in Tanzania

In a bid to enhance the safety and health of its agricultural sector, Tanzania has introduced new fees and charges for inspection services on imported and exported plant products. This initiative, part of the Tanzania Finance Act 2024, aims to ensure adequate funding for the Agricultural Development Fund and the Consolidated Fund, supporting regulatory compliance and plant health standards nationwide.

Agriculture is a cornerstone of Tanzania’s economy, with plant health being critical to the sector’s productivity and export potential. Introducing inspection fees is a strategic move to ensure that the country’s agricultural products meet international health standards, thereby protecting both local farmers and international trade relations.

The new fees will be applied to various inspection services for importing and exporting plant products. These charges are intended to cover the costs associated with maintaining high standards of plant health, including detecting and preventing pests and diseases that could harm crops and ecosystems.

Streamlining Tax Appeals in Tanzania for Efficient Resolution

In a bid to expedite the resolution of tax disputes, the Tanzanian government has implemented a new provision requiring that tax appeals be settled amicably within sixty days. This change, part of the Tanzania Finance Act 2024, aims to reduce the time and resources spent on prolonged litigation, thereby enhancing the tax system’s efficiency.

Tax disputes can be lengthy and costly for taxpayers and the government. The new sixty-day settlement period is designed to streamline the tax appeals process, ensuring quicker resolutions and reducing the backlog of pending cases. This initiative is expected to improve the overall efficiency of the tax administration system, benefiting both the Tanzania Revenue Authority (TRA) and taxpayers.

The new provision mandates that all tax appeals must be settled amicably within sixty days from the date the Board or Tribunal issues an order. This period encourages both parties to resolve disputes quickly and fairly, avoiding the need for extended litigation.