Smallholder farmers in Sumbawanga receive financing, inputs, and real-time agronomic support in landmark partnership

SUMBAWANGA, Tanzania — Equity Bank (Tanzania) Limited and agricultural technology platform MazaoHub have formalized a partnership aimed at transforming how smallholder farmers access and repay farm financing, with the 2025/2026 growing season serving as the pilot.

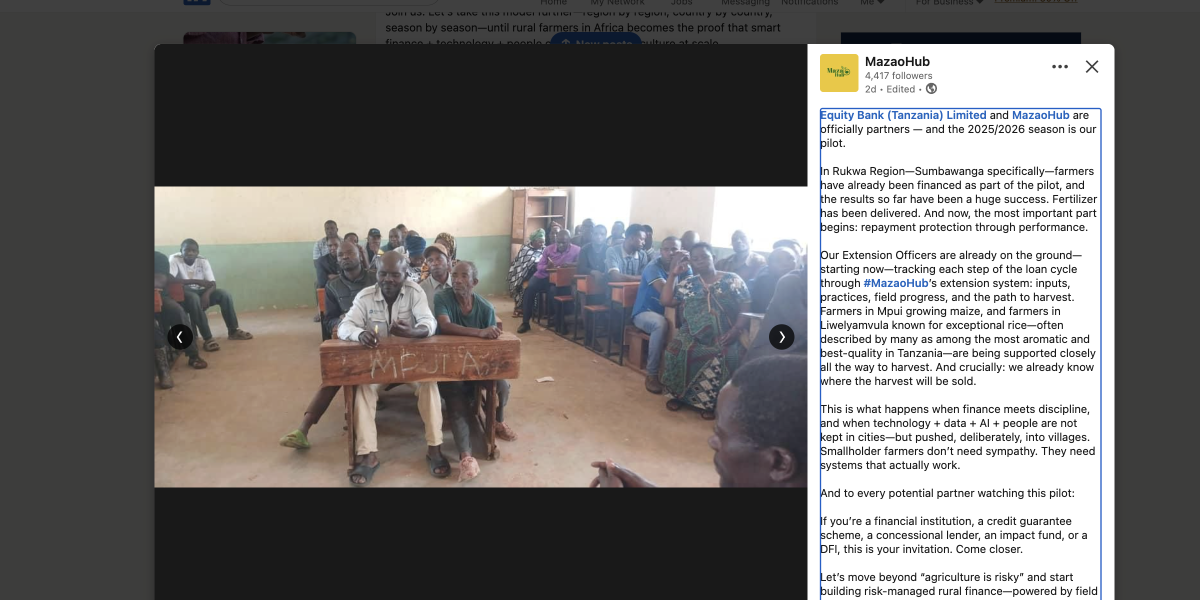

The partnership, announced this week, is already operational on the ground in Rukwa Region, where farmers in two communities have received loans and input deliveries as part of the first phase. Maize farmers in Mpui and rice farmers in Liwelyamvula — a community recognized for producing some of Tanzania’s most aromatic and highest-quality rice — are among the first beneficiaries.

What sets this model apart, according to MazaoHub, is the integration of technology and human oversight throughout the entire loan cycle. Extension officers deployed by the company are actively tracking inputs, agronomic practices, and field progress through MazaoHub’s proprietary extension system, with the goal of protecting loan repayment through farm performance rather than collateral alone.

Critically, offtake arrangements are already in place — meaning the partnership has identified buyers for the harvest before the crop is even in the ground.

“Smallholder farmers don’t need sympathy. They need systems that actually work,” MazaoHub said in a statement announcing the partnership, describing the model as one that combines field verification, real-time agronomic support, traceable input delivery, and predictable offtake into a data-driven risk management framework.

The announcement is drawing attention beyond Tanzania. MazaoHub has issued an open call to financial institutions, credit guarantee schemes, concessional lenders, impact funds, and development finance institutions to engage with the pilot as it scales.

“Let’s move beyond ‘agriculture is risky’ and start building risk-managed rural finance,” the company said, framing the Rukwa pilot as a replicable model that could expand region by region and country by country.

The pilot comes at a time when access to agricultural finance remains one of the most persistent barriers to smallholder productivity across sub-Saharan Africa, with rural lending typically constrained by perceptions of high risk and limited repayment infrastructure.

MazaoHub positions its approach as a direct answer to that challenge — one that pushes technology, data, and human capital into villages rather than concentrating them in urban centers.

Interested partners can reach MazaoHub at info@mazaohub.com.

This story is based on a public statement issued by MazaoHub via LinkedIn.