Kilimokwanza.org Team

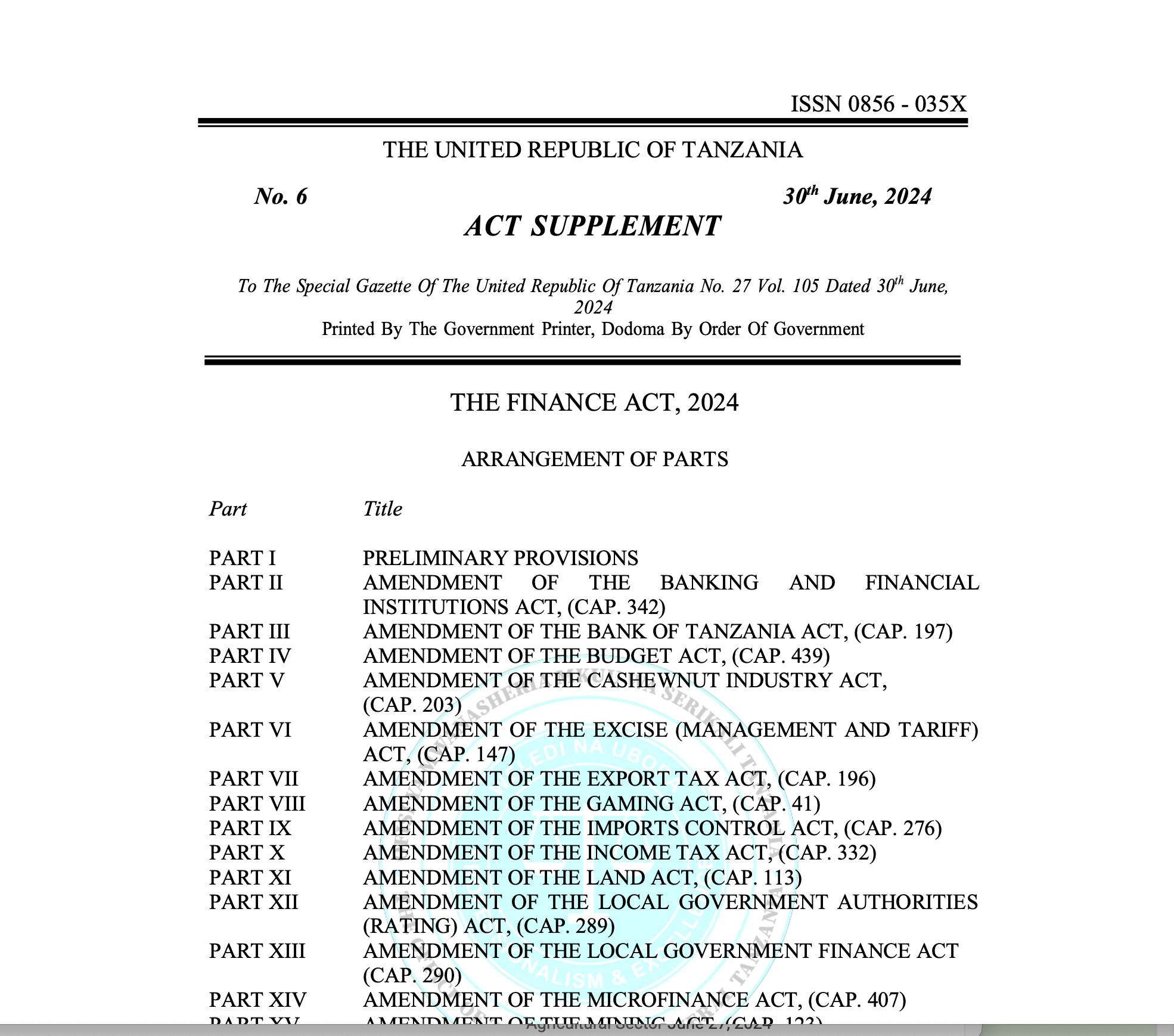

Tanzania’s Finance Act 2024 introduces significant changes to the country’s financial landscape. Here are ten key points to understand:

- Industrial Development Levy:

- What it is: A new levy on imported goods for home consumption in Mainland Tanzania.

- Exemptions: Goods originating from East African Community (EAC) Partner States that meet the EAC Rules of Origin.

- Goal: To bolster local industries and reduce reliance on imports.

- Impact: This may lead to higher consumer prices in the short term.

- Taxation of Digital Assets:

- What it is: Digital assets are now recognized as taxable entities under the Income Tax Act.

- Why it matters: This aligns Tanzania with global digital economy tax trends.

- Challenges: Valuation and reporting of digital assets may be complex.

- Centralized Sugar Importation:

- What it is: The National Food Reserve Agency (NFRA) is now the sole importer of sugar for domestic consumption.

- Goal: To stabilize the sugar market, ensure consistent supply, and address shortages and price fluctuations.

- Stricter Cargo Regulations:

- What it is: New regulations mandate that cargo consolidators adhere to customs and other relevant laws during deconsolidation.

- Goal: To improve transparency and compliance in the importation process.

- Support for the Cashew Industry:

- What it is: All export levies collected on cashews will be remitted to the Cashewnut Board for the next five years.

- Goal: To enhance the development and sustainability of the cashew sector.

- Plant Health Inspection Fees:

- What it is: New fees and charges for inspection services on imported and exported plant products.

- Goal: To enhance the safety and health of the agricultural sector and ensure adequate funding for regulatory compliance.

- Faster Tax Dispute Resolution:

- What it is: Tax appeals must now be settled amicably within sixty days.

- Goal: To expedite the resolution of tax disputes and reduce the time and resources spent on litigation.

- Financial Incentives for Tea Processing:

- What it is: “Tea processing” is included as a beneficiary of specific tax provisions until June 30, 2027.

- Goal: To promote the tea processing industry and encourage investment in the sector.

- Loans for Local Agricultural Groups:

- What it is: Local governments can issue loans to specified agricultural groups when no other applications exist.

- Goal: To empower local agricultural groups and enhance access to financial resources.

- Export Tax on Sunflower Products:

- What it is: A 10% export tax on crude sunflower oil and sunflower seeds.

- Goal: To regulate the export market and promote the addition of domestic value to sunflower products.

- Amendment of the Vocational Education and Training Act: What it is: Provision for water supply and sanitation authorities to pay casual laborers involved in implementing water and sanitation projects. Goal: To ensure fair compensation for casual laborers and support the implementation of water and sanitation projects. Benefits: Enhances the implementation of essential projects, improves agricultural productivity through better irrigation and water management, and supports the livelihoods of casual labourers.