Nairobi, Kenya – May 7, 2025 – Listed agribusiness firm Sasini Plc has released its unaudited financial results for the six-month period ended March 31, 2025, revealing a complex blend of operational challenges, strategic investment adjustments, and a cautious outlook for the remainder of the year.

📉 Revenue Declines Despite Strategic Investment Gains

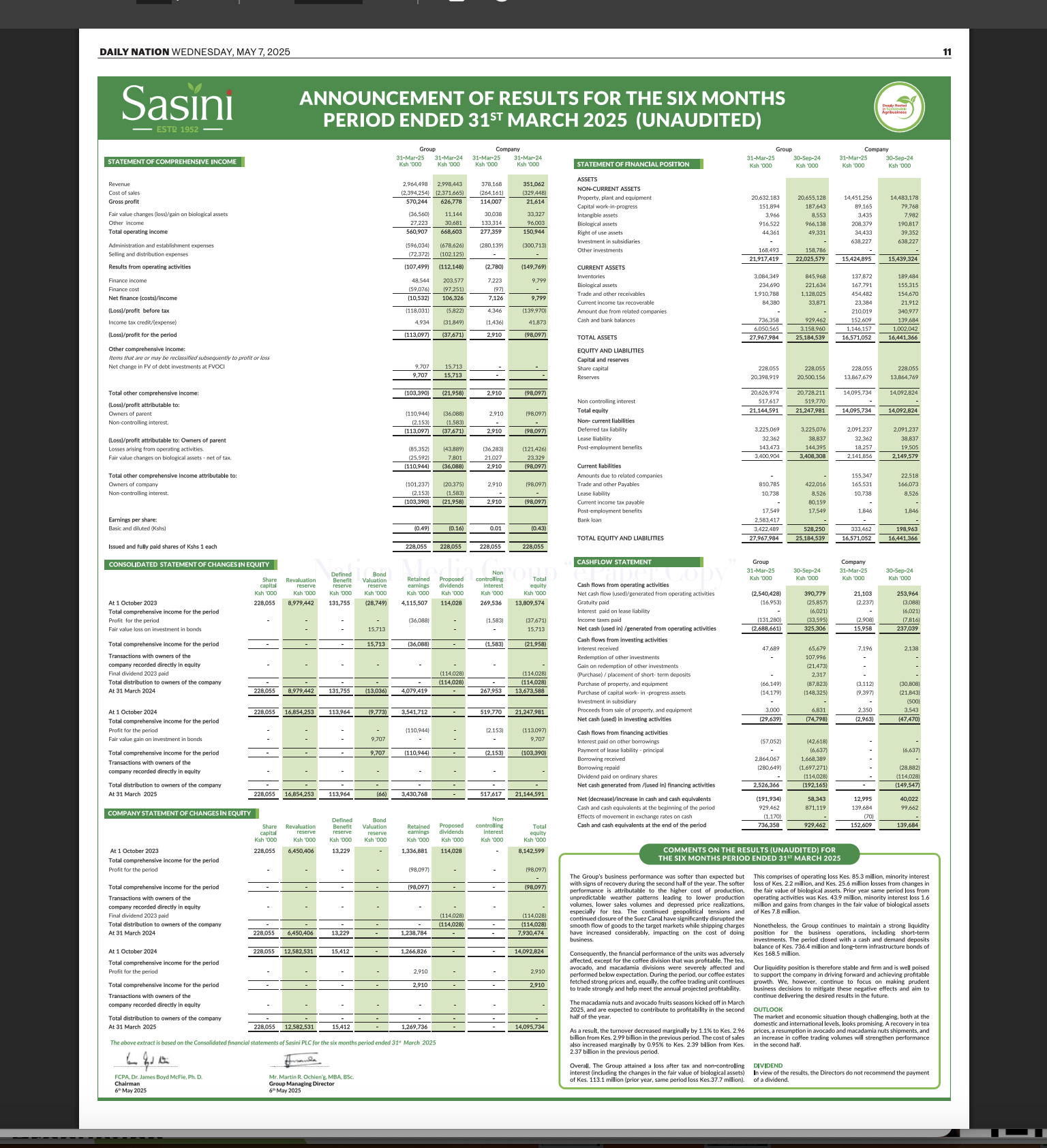

Sasini’s group revenue declined by 7.6% to KES 2.94 billion, down from KES 3.19 billion in the previous corresponding period. The dip was largely attributed to lower export prices for tea and coffee—key revenue drivers for the group. Additionally, global commodity price volatility and subdued demand in key international markets placed pressure on margins.

However, on a positive note, Sasini reported KES 133.7 million in fair value gains from biological assets, reversing a loss of KES 135.5 million recorded in H1 2024. This marked improvement signals better valuation and productivity from its core plantation operations.

📉 Operating and Net Losses

Despite fair value gains, operating profit dropped by 70.5%, from KES 394.3 million to KES 116.4 million. This sharp decline was mainly due to increased operating costs, particularly in fuel, fertilizers, and labour, which remain elevated across the agriculture sector.

The group posted a loss before tax of KES 153.7 million, a stark contrast to the KES 211.8 million profit reported in the same period last year. After-tax losses stood at KES 111.6 million, placing further pressure on shareholder returns.

💼 Financial Position Remains Stable

Despite the losses, Sasini maintained a strong asset base of KES 6.7 billion, up slightly from the previous period. Notably, non-current assets remained stable, and total equity stood at KES 5.25 billion for the group, reflecting strong capital retention and prudent balance sheet management.

The cash position, however, saw some tightening. Net cash used in investing activities amounted to KES 134.4 million, reflecting continued capital investment in farms and processing facilities, even amid tighter margins.

🧾 Dividend Withheld

In line with its cautious stance, the Board of Directors did not recommend the payment of an interim dividend, citing the need to preserve liquidity during a period of economic and operational uncertainty.

📌 Outlook and Strategic Focus

Management acknowledged the challenges posed by erratic weather, high input costs, and global pricing pressures, but reiterated its commitment to strengthening efficiencies across the tea, coffee, dairy, and macadamia value chains.

“While the current environment remains tough, Sasini continues to invest in long-term sustainability, including mechanization, climate resilience strategies, and expanding domestic value addition,” the statement read.

🔍 Key Highlights at a Glance

- Revenue: KES 2.94 billion (↓ 7.6%)

- Operating Profit: KES 116.4 million (↓ 70.5%)

- Net Loss After Tax: KES 111.6 million

- Total Assets: KES 6.7 billion

- Total Equity: KES 5.25 billion

- Fair Value Gain on Biological Assets: KES 133.7 million (vs loss in 2024)

- Dividend: Not declared

Sasini’s half-year performance reflects the broader volatility in Kenya’s agricultural export sector. However, the group’s asset strength and continued investments position it for recovery—should macroeconomic and weather conditions stabilize in the second half of the year.